Few more options terms which are very relevant for understanding once we start talking about strategies:

As if Long and Short was not confusing enough or Bullish/Bearish was not sexy enough, Option traders created their own words for conveying essentially the same thing. So if you want to go long or bullish on some script then you are interested in Call Option. Obviously when you want to go short or bearish about something, you will look for Put Option.

Please note that it is the simplest explanation that I can give you at this moment. Funny thing about Options is you can trade both Call/Put Options in either of Bullish/Bearish case but let us not jump the gun. We will have another day and another time for that.

Lot Size:

One option is usually called as contract and it can contain multiple quantity of underlying. In our example, one contract meant one Tonne of sugar cane for which the premium was 100 Rs. However, had it been apple, it could have been 100 Rs for every 1000 apples. One NIFTY option contract has 50 Nifty in it.

Open Interest:

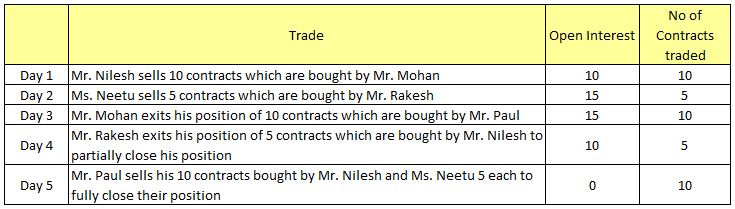

Unlike shares where we know exactly how many are issued in the market and how many are traded on any given day, Options do not have any fixed number. Someone creates one option which acquires some meaning only if someone buys it. Open Interest essentially mean one completed leg of such creating and buying one contract of Option. So someone creates 10 contracts and finds a buyer for them then 10 contracts are added to Open Interest. However if the seller in this transaction sells his contracts to someone else and closes his position then nothing is added to Open Interest. This is simply because the same option is traded here. It was not created new... it just changed hands. You can read a short note on Open Interest to know more.

A common misconception is that open interest is the same thing as no of option contracts traded. The difference is explained with a short scenario here:

Hope this example will help clear your concept of Open Interest. High OI suggests lot of interest in the contract and sometimes a useful indicator. We will discuss that later.

Put/Call Ratio:

As the name suggests, it is a ratio of the trading volume (not Open Interest) of put (short) options to call (long) options. It is used to gauge market expectations. For example, a high volume of puts compared to calls indicates a bearish sentiment expecting market to weaken. This is also an useful indicator while trading options.

There is at least one more post needed on basic definitions related to Options before we get to trading them. Even in between the trades I will keep posting on some high fandu terminologies and definitions which are used by professional traders.

Then the turn will come for strategies. Simple, sweet, successful, superb, s-effective, s-easy strategies. Probably wrote that on s-unday. Did I get it across?

Nicely put... waiting for next post.

ReplyDeleteWell explained. Hope you start posting about trading soon.

ReplyDelete