So what is Strangle?

Just like in previous post, you are unsure of direction of the big move. However you have inkling that it is more likely will be in positive direction. At the same time, you don’t want to bet in one single direction and want to cut your losses in case you are wrong.

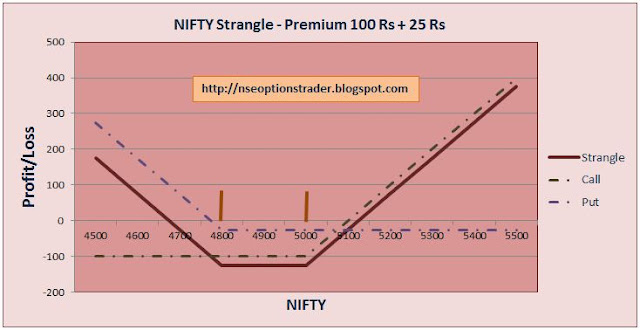

So Strangle comes to your rescue. Only difference between Straddle and Strangle is that the Strike Price of the Call and Put options is different. In Strangle for our scenario, you buy 5000 Call option for 100 Rs premium (5000 Rs) but while buying Put option, you buy 4800 Put for 25 Rs premium (25 x 50 = 1250 Rs). What this basically does is that your break-even point on the (more likely) positive side is reduced and you start making money as soon as NIFTY crosses 5125 level. Graph is once again helping us understand it.

You are making money earlier in positive direction and at the same time you are protected from extreme downside. So if market drops sharply, your put option gains in value. It reduces your overall loss or in extreme down move, you can still make money albeit a little less. Break-even on upside is 5125 and on the downside 4675. You are in a better position to benefit more and sooner from the positive move (which we believe is more likely at the start) and still have some protection from the downside. Like in previous post, this is a long strangle.

Now, let us talk about not holding these positions till expiry date as we have been assuming for last three posts. Take example of Strangle trade in this post. If you see that you are wrong and market is moving in opposite (negative) direction, the Call Option premium will start dropping. So rather than holding it till very last date… you square off your Call position (you sell the same option) back in the market for let us say 50 Rs Premium losing 2500 Rs ((100-50) x 50 = 2500 Rs).

At the same time, since market is moving in negative direction, your Put Option premium will rise in value and 25 Rs premium may quickly jump to 50 Rs. Since the market is anyway moving in negative direction, you may want to hold Put Option a little longer and actually recover entire loss in Call premium through you Put position. Strangle is usually more popular and practical strategy for newbies.

No comments:

Post a Comment